Kansas Public Employees Retirement System overview

Kansas Public Employees Retirement System related stories

KPERS commits $220 million to private equity

KPERS has made commitments to two new private equity funds.

KPERS commits $110m to PE, sets alternatives investment limit at 25%

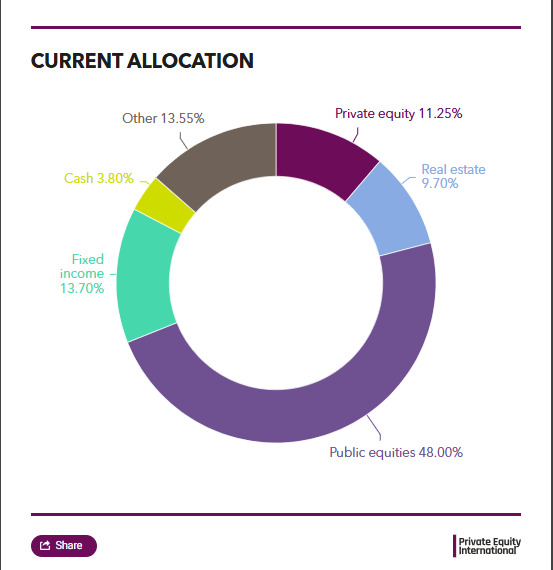

Kansas Public Employees Retirement System currently allocates 11.25% of its total assets to private equity.

KPERS shares PE pacing plan

Kansas Public Employees Retirement System has published its private equity pacing plan for 2023 according to materials from the public pension's November investment committee meeting.

KPERS confirms $150m in commitments

The US public pension has backed a pair of private equity vehicles which are in market seeking upwards of $30bn in investor capital.

KPERS approves $50m PE commitment

The US public pension has backed New Mountain Capital's latest fund in its flagship series.

KPERS approves $50m commitment

The US public pension has backed Ares Management's latest series corporate opportunities fund.

KPERS ups PE target allocation

The US public pension has boosted its target allocation to the asset class.

Kansas Public Employees Retirement System contact information

Offices

Contacts

| Name | Job title | Location | |

|---|---|---|---|

Job titleChief Investment Officer | LocationTopeka, United States | Email | |

Job titleInvestment Officer, Private Markets | LocationTopeka, United States | Email | |

Job titleDeputy Chief Investment Officer, Private Markets | LocationTopeka, United States | Email | |

Job titleVice Chairperson, Investment Committee | LocationTopeka, United States | Email | |

Kansas Public Employees Retirement System fund commitments

Known fund commitments : 148

| Fund | Manager | Commitment date | Commitment size |

|---|---|---|---|

Manager | Commitment dateSep 2023 | Commitment size$60m | |

Manager | Commitment dateSep 2024 | Commitment size | |

Manager | Commitment dateMay 2025 | Commitment size | |