Los Angeles Water & Power Employees Retirement Plan overview

Los Angeles Water & Power Employees Retirement Plan related stories

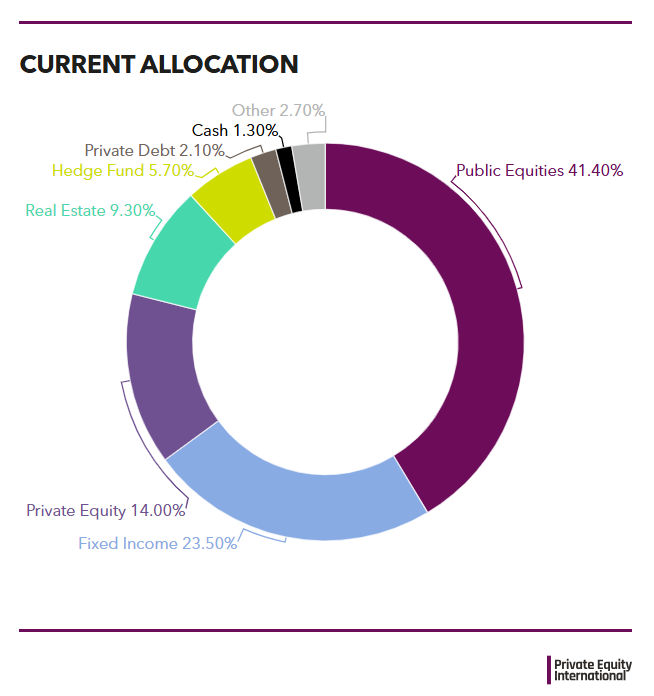

Investor Intentions: LADWP receives a private equity pacing plan

Los Angeles Water & Power Employees Retirement Plan received a private equity pacing plan recommendation from its investment consultant Stepstone Group.

LADWP commits $120m to Clearlake Capital Group

Los Angeles Water & Power Employees Retirement Plan splits the amount between two Clearlake funds.

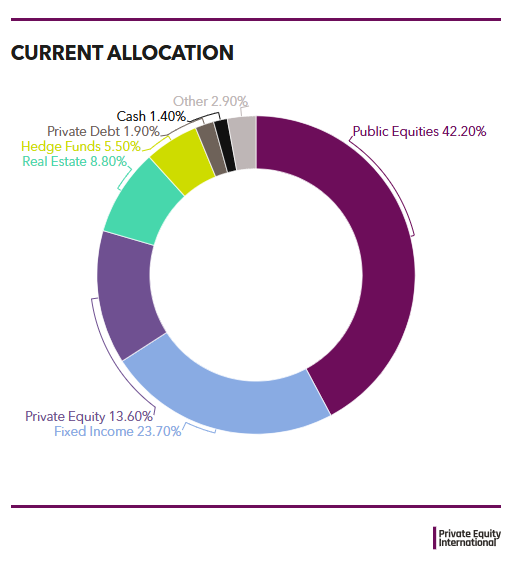

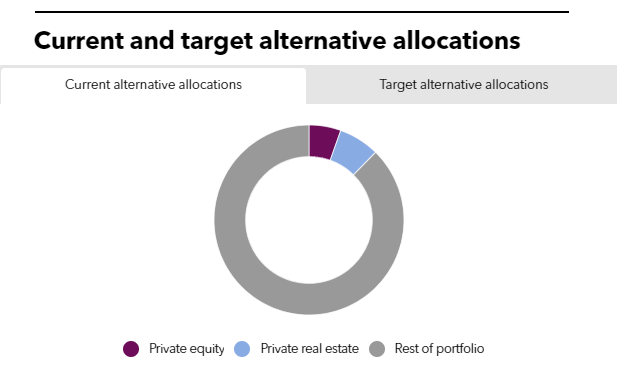

Los Angeles Water & Power outlines PE pacing

The Los Angeles Water & Power Employees Retirement Plan has revealed its private equity pacing plan recommended by its investment consultant RVK.

Vitruvian smashes target for fourth fund

The London-based mid-market firm gathered €4bn in less than three months for its largest vehicle yet.

LADWP approves $100m commitment

The US public pension has backed a diversified North American buyout fund.

LADWP approves $250m in commitments

The US public pension has backed two diversified buyout funds targeting North America and Western Europe.

Providence collects close to $8bn in double fundraise

The US manager, which has yet to hold official final closes on its eighth flagship fund and fourth strategic growth fund, is also in market with a Europe growth vehicle.

Los Angeles Water & Power Employees Retirement Plan contact information

Offices

Contacts

| Name | Job title | Location | |

|---|---|---|---|

Job titleInvestment Officer, Private Equity | LocationLos Angeles, United States | Email | |

Job titleCIO | LocationLos Angeles, United States | Email | |

Job titleRetirement Plan Manager | LocationLos Angeles, United States | Email | |

Job titleInvestments Officer | LocationLos Angeles, United States | Email | |

Los Angeles Water & Power Employees Retirement Plan fund commitments

Known fund commitments : 99

| Fund | Manager | Commitment date | Commitment size |

|---|---|---|---|

Manager | Commitment dateAug 2025 | Commitment size$100m | |

Manager | Commitment dateMay 2025 | Commitment size | |

Manager | Commitment dateDec 2024 | Commitment size | |