Orange County Employees Retirement System overview

Orange County Employees Retirement System related stories

California's Orange County to cut fund of funds exposure through secondaries sales

The $25bn pension expects to use both the GP-led and the LP-led markets to offload indirect private equity exposure.

OCERS commits $92.5m to private equity

The public pension made commitments to five private equity funds.

California pension banks on rising dealmaking to lift below-average PE distributions

Orange County Employees Retirement System's private equity portfolio generated 6.5% of distributions over the past year – a figure 'notably lower' than expected.

Orange County pension considers expanding PE team amid co-investment ramp-up

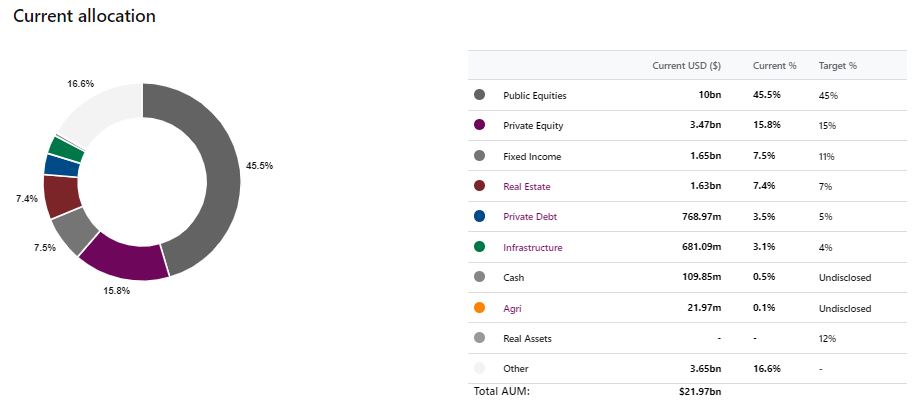

The $21bn California pension is preparing a more hands-on investment approach in private markets, including more co-investments, GP stakes and joint ventures.

Wafra adviser seeks up to $1.2bn for debut GP stakes fund – updated

Founding investors in Collective Global include the Orange County Employees Retirement System and the City of San Jose Retirement System.

Orange County announces new commitments

The Santa Ana, California-based Orange County Employees Retirement System has revealed six new commitments including $50m each to American Industrial Partners Fund VIII, Ares Pathfinder II and TCG Crossover Fund II.

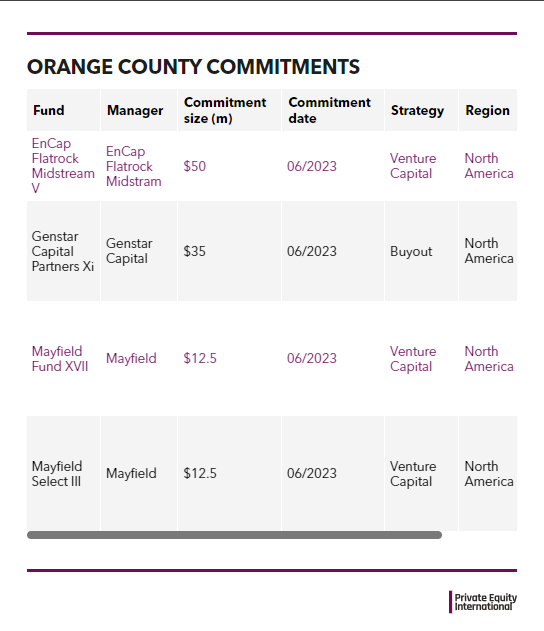

OCERS commits $110m

The Orange County Employees' Retirement System has committed to four new private equity funds, including EnCap Flatrock Midstream V.

Orange County Employees Retirement System contact information

Offices

Contacts

| Name | Job title | Location | |

|---|---|---|---|

Job titleInvestment Officer | LocationSanta Ana, United States | Email | |

Job titleDirector of Investments | LocationSanta Ana, United States | Email | |

Job titleInvestment Officer | LocationSanta Ana, United States | Email | |

Job titleInvestment Analyst, Private Markets | LocationSanta Ana, United States | Email | |

Orange County Employees Retirement System fund commitments

Known fund commitments : 415

| Fund | Manager | Commitment date | Commitment size |

|---|---|---|---|

Manager | Commitment dateOct 2024 | Commitment size$50m | |

Manager | Commitment dateDec 2024 | Commitment size | |

Manager | Commitment dateJan 2025 | Commitment size | |