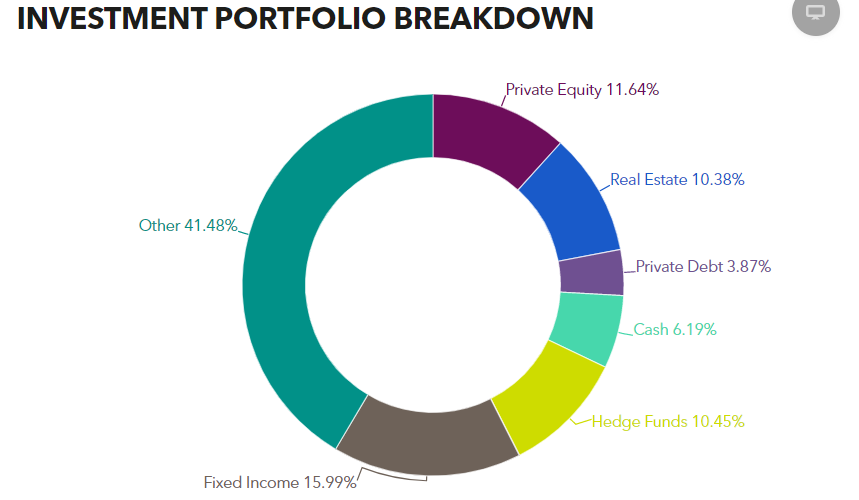

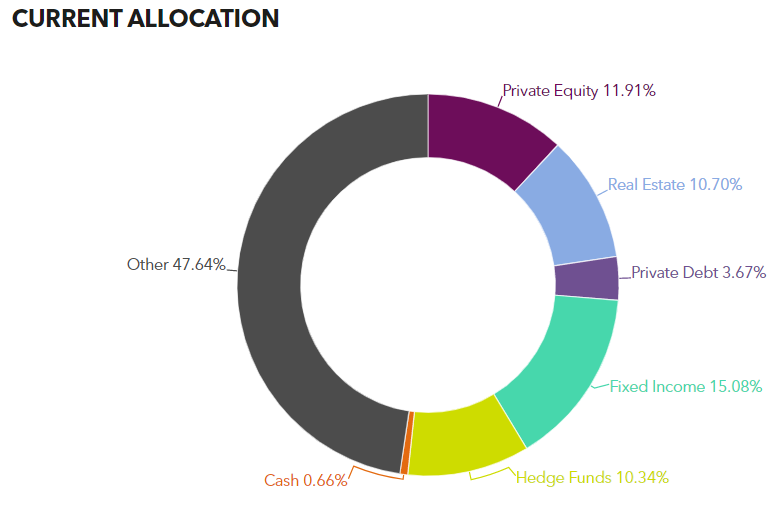

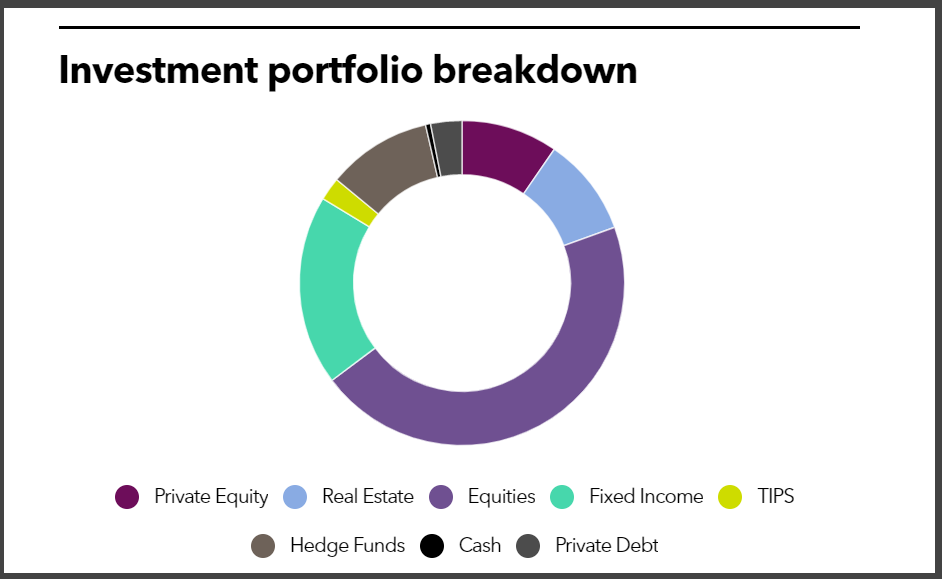

West Virginia Investment Management Board overview

West Virginia Investment Management Board related stories

West Virginia commits $60m to buyout funds

US public pension backs two buyout vehicles with $30bn each.

WVIMB boosts PE exposure in portfolio adjustment

The objective of the public pension is to increase and vary its investments in private equity.

PE ranks as strongest asset class for pensions over the past decade – survey

Illinois State Board of Investment tops the list of public pension systems with the strongest private equity returns.

WVIMB confirms $150m in commitments

The US public pension backed six PE funds between January and April 2020.

WVIMB's investment plans remain unchanged amid Covid-19

The US public pension will continue investing into private equity over the next 12 months.

Is Sycamore barking up the wrong tree?

Private equity investors and competitors are either scratching their heads at Sycamore’s purchase of brick-and-mortar retailer Staples or see its founder Stefan Kaluzny as a 'brilliant inventive contrarian'.

West Virginia Investment Management Board contact information

Offices

Contacts

| Name | Job title | Location | |

|---|---|---|---|

Job titleExecutive Director, Chief Investment Officer, Chief Executive Officer and Member of Alternative Investment Committee, Private Equity and Real Estate | LocationCharleston, United States | Email | |

Job titleInvestment Committee Member | LocationCharleston, United States | Email | |

Job titleInvestment Officer, Private Equity | LocationCharleston, United States | Email | |

Job titleInvestment Committee Member | LocationCharleston, United States | Email | |

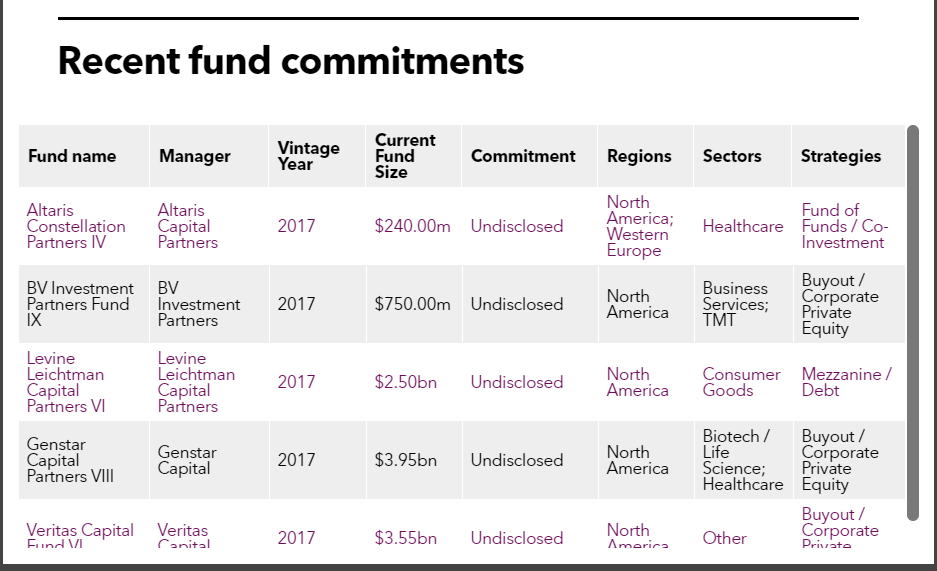

West Virginia Investment Management Board fund commitments

Known fund commitments : 146

| Fund | Manager | Commitment date | Commitment size |

|---|---|---|---|

Manager | Commitment dateJun 2025 | Commitment size$30m | |

Manager | Commitment dateJun 2025 | Commitment size | |

Manager | Commitment date- | Commitment size | |